Research

Global Economic Crisis, Globalization, and Development

Sociologists have consistently explored the impact of economic globalization on local communities worldwide. Over the past four decades, expanding international trade has increased national, regional, and local economies integration into the global market. This evolution has given rise to intricate, interconnected production and trade networks, forming the backbone of the modern world economy. However, despite the recent surge in economic globalization, this heightened interconnectedness has also transformed economic inequalities between and within nations.

Economic markets have reached unprecedented global interconnectivity. Investments by people, firms, organizations, and governments now span across the globe, making economies more interdependent than ever. This interconnectedness means economic downturns in one nation can rapidly and significantly impact the global market. A prime example is the 2008 U.S. housing market collapse, swiftly rippling the world economy. The last four decades of economic globalization set the stage for the tumultuous worldwide impact of the 2008-2009 Global Economic Crisis. While existing literature provides insights, it needs more clarity on the long-term effects of the 2008-2009 crisis on global economic trends. My research contributes significantly to this area, offering a nuanced understanding of the crisis’s impact on the trajectory of economic globalization. By analyzing patterns and shifts in global economic interdependencies post-2008, my work enriches sociological perspectives on global market dynamics, enhancing our understanding of contemporary social, economic, and political phenomena.

My research adopts a social network perspective to investigate the relationship between global trade, economic crises, and economic productivity across both macro and meso levels of the world economy. Specifically, I aim to answer the following questions:

- How did the hierarchy of the global trade network adapt to the impact of the 2008–09 global economic crisis?

- How did a country’s position in the hierarchy influence their upward mobility during the crisis?

- To what extent does a country’s position within the world-system hierarchy influence its economic productivity, especially after a global economic downturn?

Below are snapshots of my research projects that are dedicated to the

study of crisis, globalization, and structural inequality at the

macro-level of the world economy. Using international trade data from

the International Monetary Fund’s Direction

of Trade Statistics, I constructed network trade data of 191

countries across a 17-year time-period (2001-2018). Data analysis was

completed using the sna package

in R Studio.

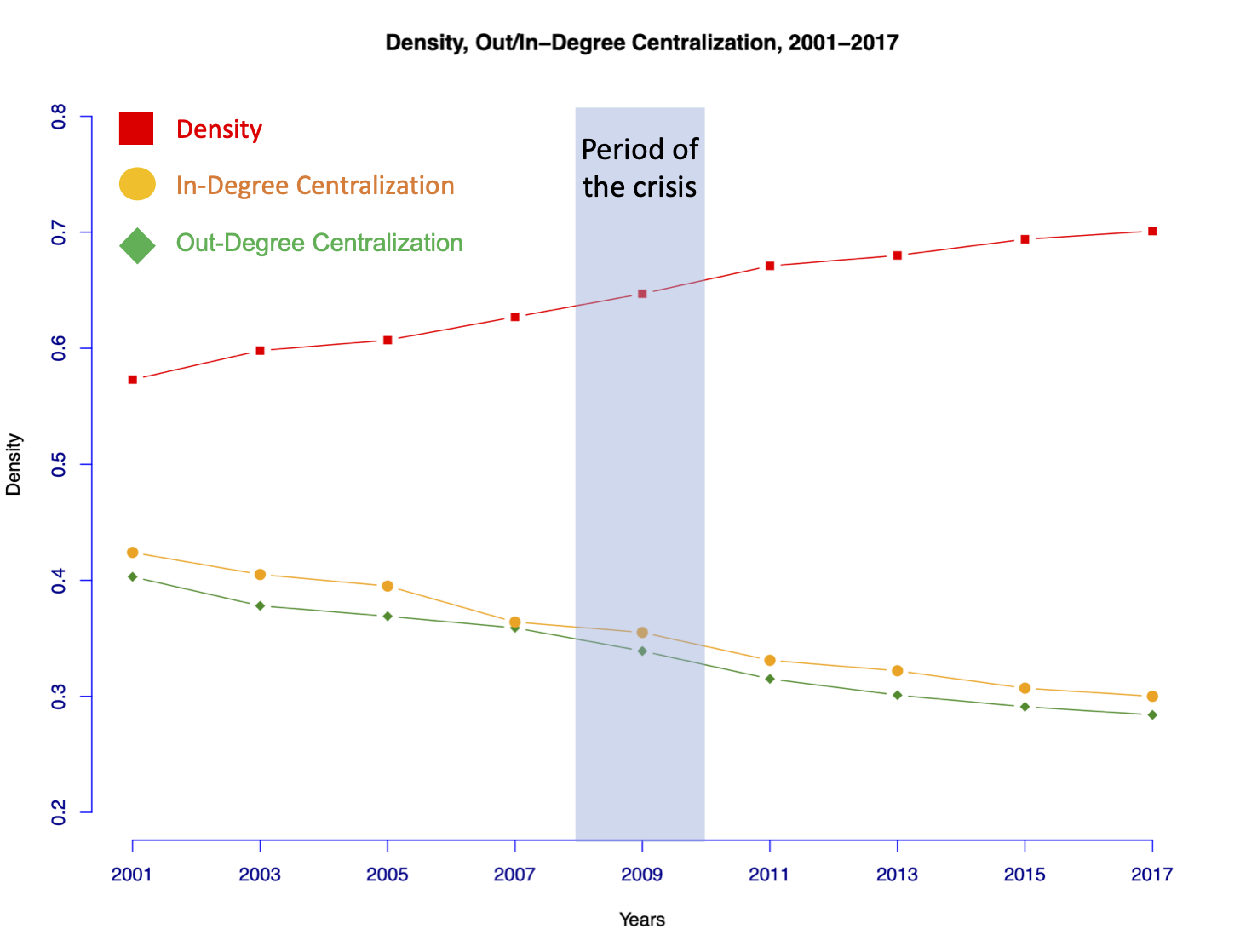

Density and Centralization in the Global Trade Network

The size and density of a social network are important indicators for measuring network connectivity. Network size refers to the number of nodes in a network and is critical for the structure of social relations and formation of hierarchies within the network. The density of a graph measures of how many ties between actors exist compared to how many ties between actors are possible.

In- and Out-Degree Centralization

Degree centralization– The distribution of influence and prestige in the network. When network ties are directed, we factor both the volume of ties sent (out-degree) and ties received (in-degree).

Out-degree centralization typically indicates influence.

In-degree

centralization indicates prestige or popularity.

Density and Degee Centralization in the Global Trade Network

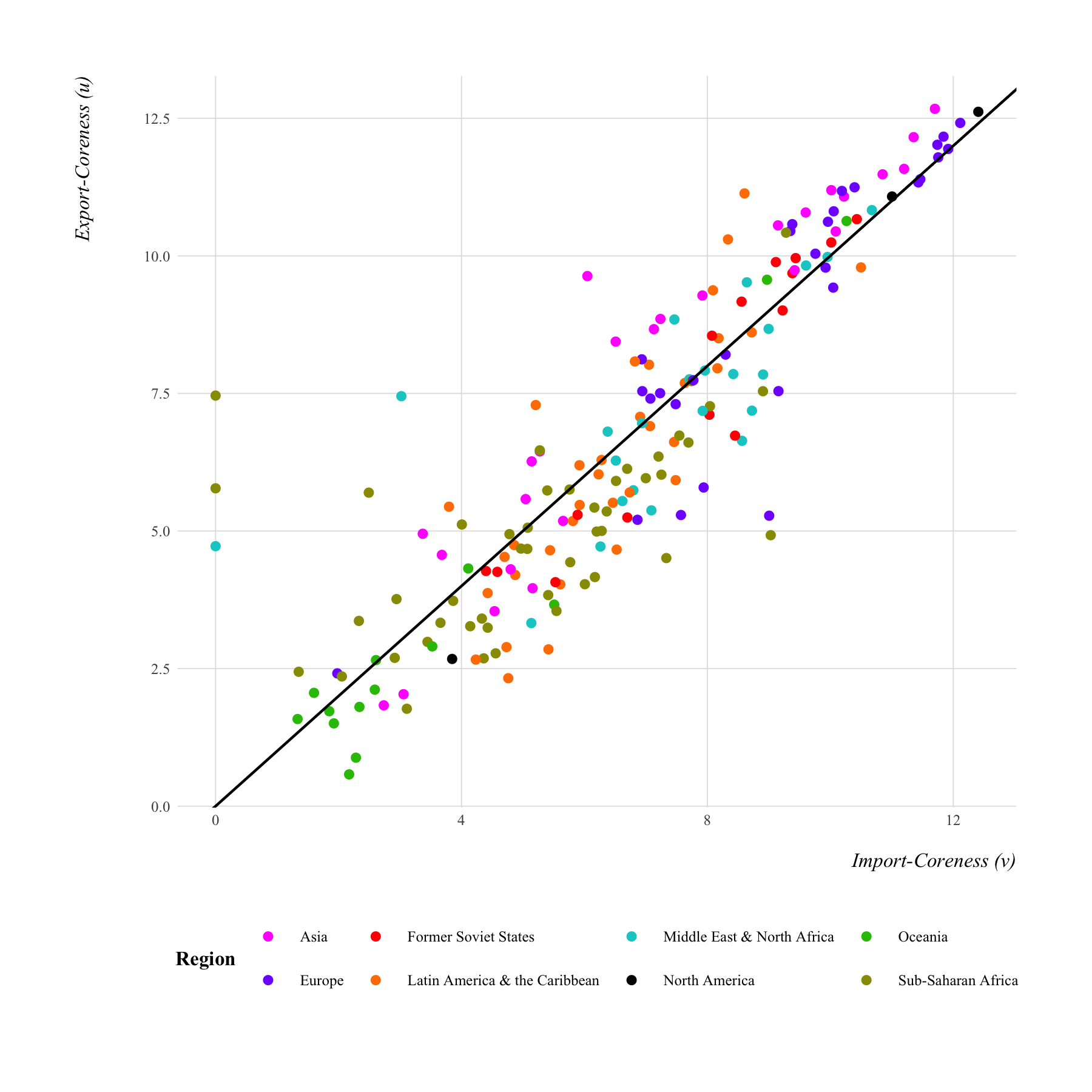

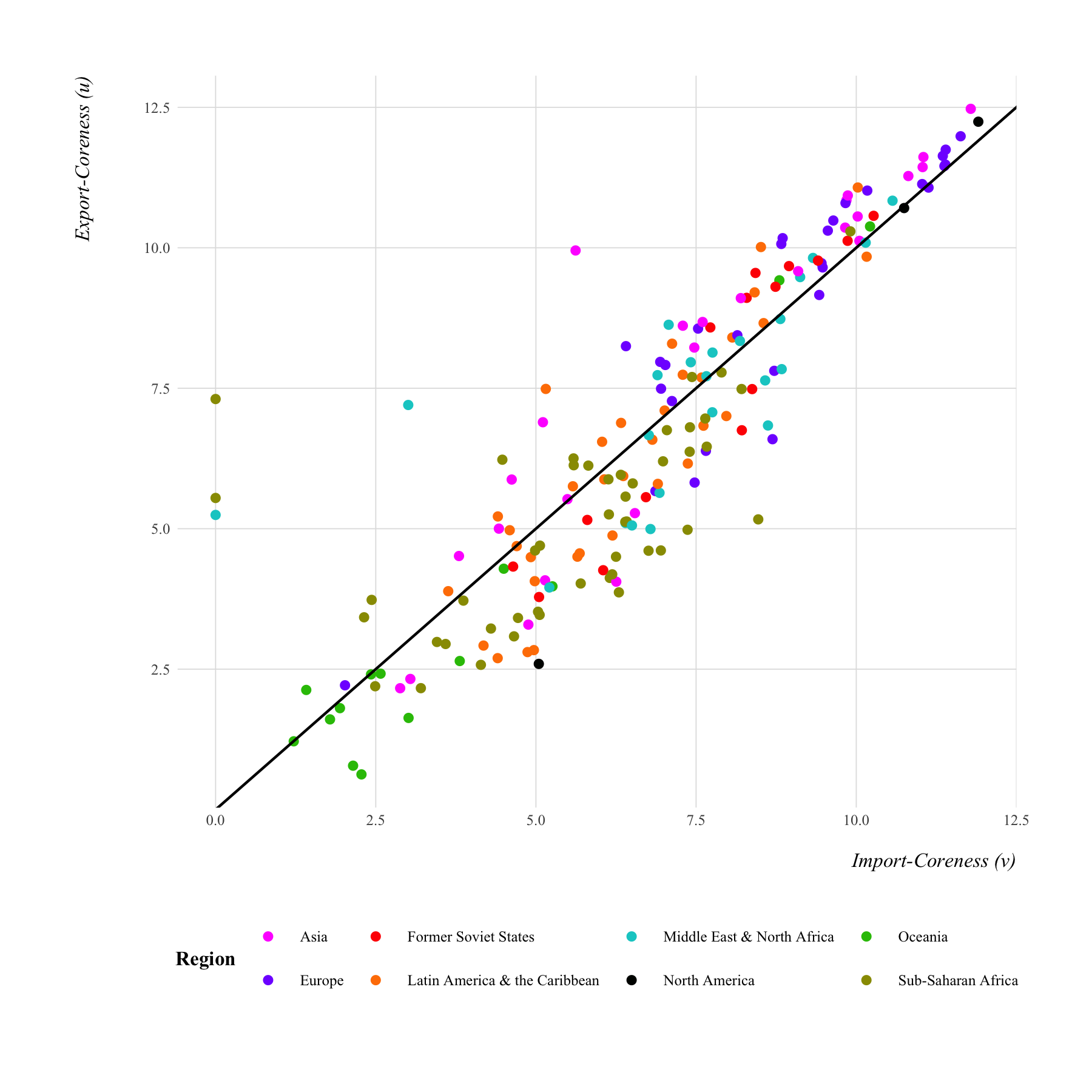

The Core-Periphery Structure of the Global Trade Network

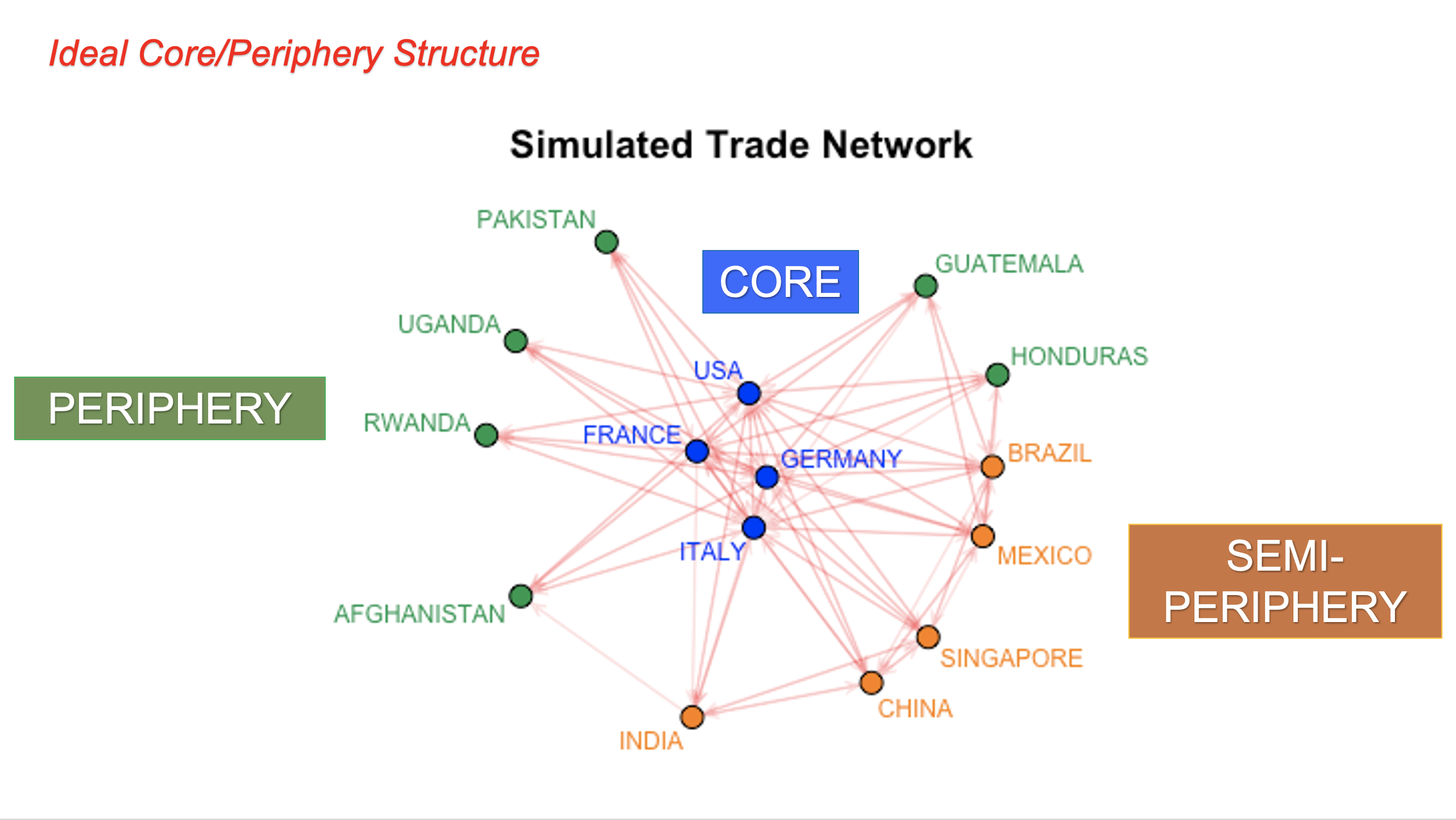

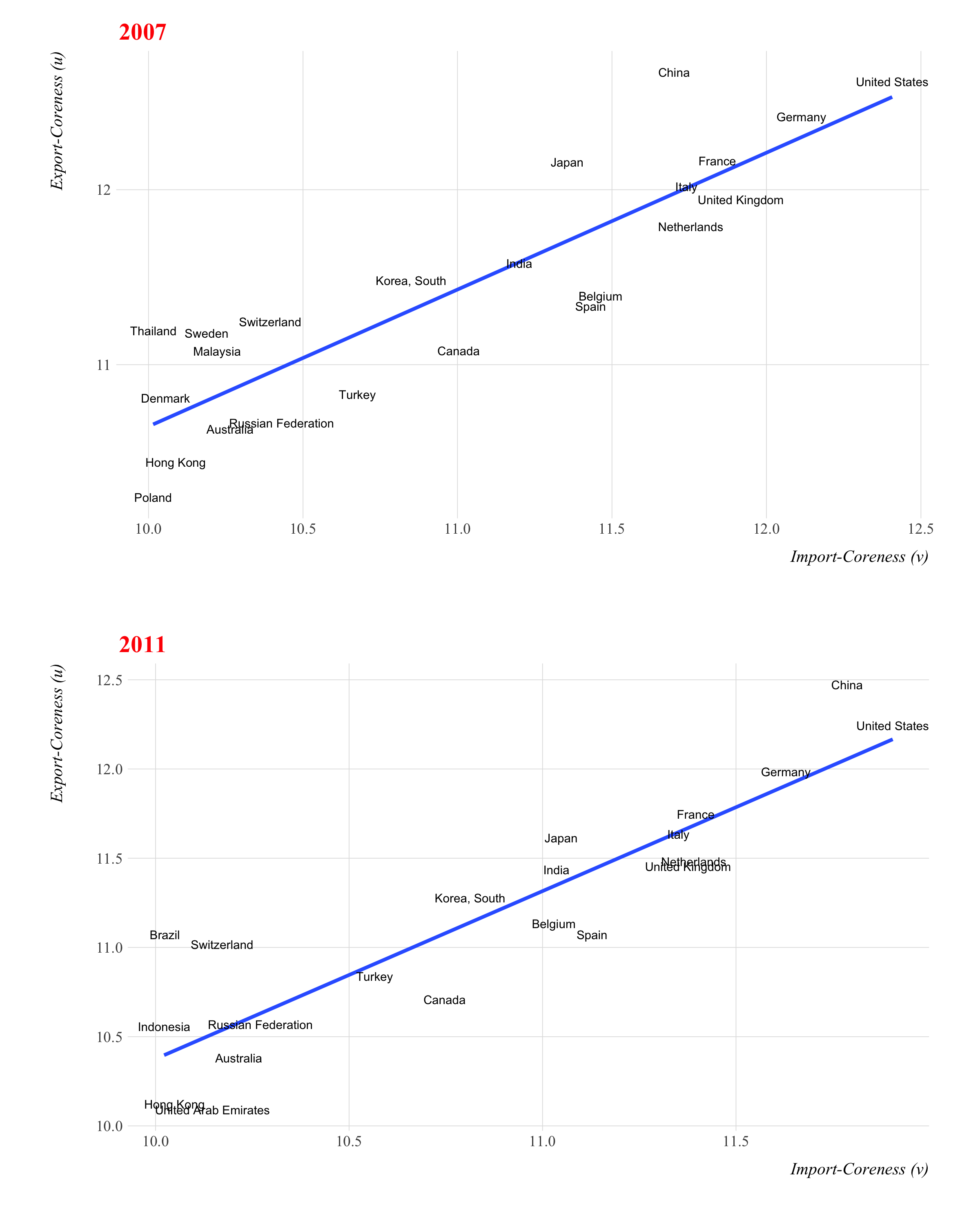

The late 20th-century wave of globalization has configured a global international division of labor, forming a core-periphery structure. In social network analysis, this core-periphery structure signifies a network with two distinct components: a densely connected ‘core’ of actors and a sparser ‘periphery.’ The peripheral actors are closely linked to the core but loosely connected among themselves. Regarding global trade, the core nations are highly interconnected within the global economic system, engaging extensively with most other nation-states. In contrast, peripheral nations are less interconnected, relying predominantly on their economic ties with the core countries for their economic activities.

The Core/Periphery Structure in 2007

The Core-Periphery Structure in 2011

The top 20 nation-states in the core-periphery structure

Copyright © 2024 Martín Jacinto. All rights reserved.